Making Money vs Making Wealth: Understanding the Difference and Pursuing Financial Freedom

In the pursuit of financial success, it is crucial to grasp the disparity between making money and making wealth. While both concepts involve the generation of income, they diverge in their long-term implications and ultimate objectives. By comprehending this distinction, individuals can make informed decisions and actively pursue financial freedom.

[ez-toc]

Understanding the Difference and Pursuing Financial Freedom

Introduction:

In the pursuit of financial success, it’s essential to understand the distinction between making money and making wealth. While both concepts involve generating income, they differ in their long-term implications and ultimate goals.

In this blog post, we’ll explore the differences between making money and making wealth, and how individuals can pursue strategies that lead to lasting financial freedom and prosperity.

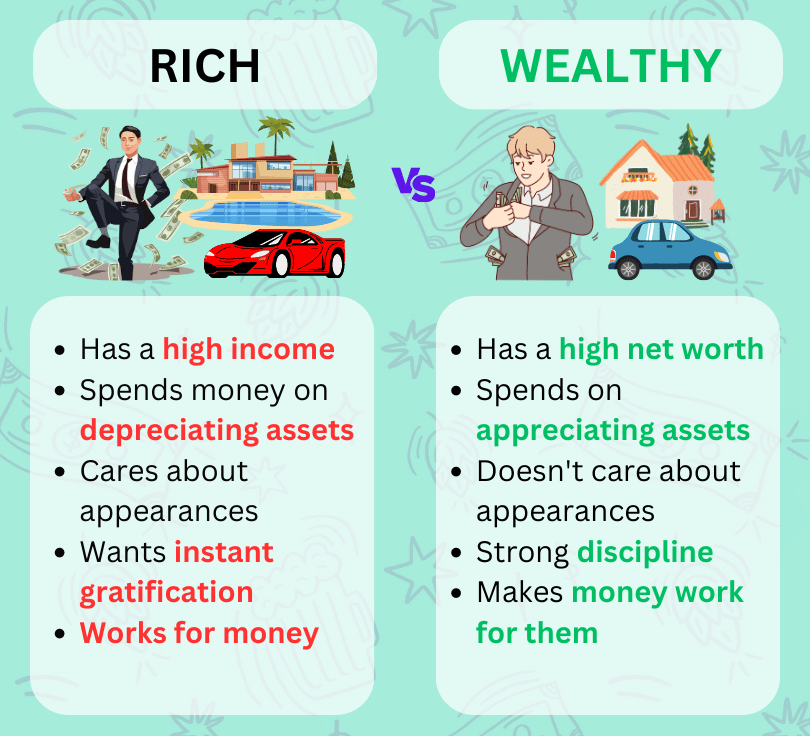

Making Money:

Making money typically refers to earning income through various means such as employment, entrepreneurship, investments, or other sources.

It involves generating cash flow to meet immediate needs, cover expenses, and enjoy a certain standard of living. Making money is essential for fulfilling day-to-day requirements, achieving short-term goals, and maintaining financial stability.

However, making money alone does not guarantee long-term financial security or wealth accumulation. Without proper planning and strategic wealth-building strategies, the income earned may be susceptible to inflation, market fluctuations, and unforeseen expenses. Therefore, while making money is necessary, it’s only the first step in the journey towards building sustainable wealth.

Making Wealth:

Making wealth, on the other hand, involves creating long-term assets, investments, and financial resources that appreciate in value over time.

It goes beyond simply earning income and focuses on accumulating assets, reducing liabilities, and creating a lasting legacy for future generations. Making wealth is about generating passive income streams, building net worth, and achieving financial independence.

Unlike making money, making wealth requires a mindset shift towards long-term planning, delayed gratification, and prudent financial management. It involves strategic allocation of resources, disciplined saving and investing, and leveraging opportunities for growth and compounding.

Making wealth is about creating a sustainable foundation for prosperity that extends beyond individual earnings and encompasses broader financial goals.

Key Differences:

1. Time Horizon:

Making money is often focused on short-term gains and immediate cash flow needs. It involves earning income to cover expenses, pay bills, and enjoy a certain lifestyle. In contrast, making wealth takes a long-term perspective, focusing on building assets and investments that appreciate over time and provide lasting financial security.

2. Active vs Passive Income:

Making money typically involves active income, where individuals exchange time and effort for financial compensation. This could include salaries, wages, commissions, or profits from active business ventures. Making wealth, on the other hand, emphasizes passive income, where investments and assets generate ongoing returns with minimal ongoing effort required.

3. Risk and Reward:

Making money may involve taking risks in pursuit of higher returns or career advancement. However, the focus is often on immediate rewards and income generation. Making wealth also involves risk-taking but with a more calculated approach, balancing potential returns with long-term stability and preservation of capital.

4. Wealth Accumulation:

Making money may lead to temporary wealth accumulation, but without strategic wealth-building strategies, it may not translate into lasting financial independence. Making wealth focuses on accumulating assets, investments, and resources that appreciate over time, providing a sustainable foundation for long-term prosperity.

Strategies for Making Wealth:

1. Investing Wisely:

Allocate resources towards investments that have the potential for long-term growth and appreciation. This could include stocks, bonds, real estate, mutual funds, or other vehicles that offer opportunities for compounding returns over time.

2. Diversification:

Spread investments across different asset classes and industries to minimize risk and maximize potential returns. Diversification helps protect against market volatility and reduces exposure to individual risks.

3. Saving and Budgeting:

Practice disciplined saving and budgeting to ensure that a portion of income is allocated towards wealth-building goals. Set aside funds for investments, emergency savings, retirement planning, and other long-term objectives.

4. Passive Income Streams:

Explore opportunities to generate passive income through investments, rental properties, royalties, dividends, or other sources. Passive income provides financial stability and frees up time for pursuing other interests and goals.

5. Education and Continuous Learning:

Invest in education and personal development to enhance skills, knowledge, and expertise. Continuous learning opens doors to new opportunities, career advancement, and increased earning potential.

Conclusion:

While making money is essential for meeting immediate needs and maintaining financial stability, making wealth is about creating a lasting legacy and achieving financial independence.

By understanding the differences between the two concepts and adopting strategies for wealth creation, individuals can pursue a path towards long-term prosperity and financial freedom.

Whether through strategic investing, disciplined saving, or generating passive income streams, the journey towards making wealth requires patience, diligence, and a commitment to building a sustainable financial future.